The Changing Face of Business Banking in Texas

Amid fierce competition and rising costs, lenders are investing in specialized staff and new products and services. Yet through it all, relationships remain the foundation for serving commercial clients.

On the surface, it’s never been a better time to be a Texas business in need of a new banking partner.

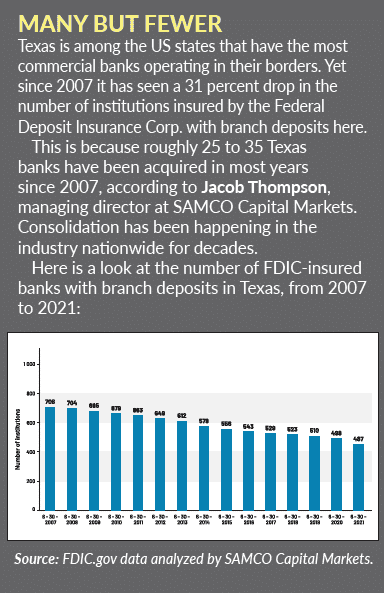

Companies can choose from 487 banks insured by the Federal Deposit Insurance Corp. that have branch deposits in this state, according to FDIC data analyzed by Samco Capital Markets.

Still, corporate leaders can struggle to find the right combination of banking products and services at the right price. Many banks, meanwhile, are facing soft loan demand from commercial customers, the product partly of issues stemming from the COVID-19 pandemic.

In Texas banks, deposits—which they use for lending—rose roughly 12 percent between year-end 2020 and ’21, according to data from the Federal Reserve Bank of Dallas. That was the result of factors like the US Federal Reserve’s pandemic-related purchases of government securities, stimulus payments, and companies stockpiling money as the economy rebounded.

“Higher than normal cash balances have decreased the need to borrow for working capital purposes as many have in the past,” said Mark Nurdin, president and CEO of the Fort Worth region at Bank of Texas. “The utilization of working capital lines of credit are at an historic low.”

On top of that, many businesses have used excess funds to pay down existing debts, experts said.

While the commercial-lending picture will eventually brighten, changes in the business of banking are forcing lenders of all sizes to reconsider how they pursue corporate clients. This is particularly true of community banks, which have seen many of their consumer customers leave for credit unions (which often have consumer-focused models) and the largest banks (which have large suites of consumer products).

“I believe [commercial banking] has the opportunity to provide longevity to the business model of the community bank,” said Robert Hulsey, president and CEO of Terrell-based American National Bank of Texas.

The Right Banking Relationship

Companies that need banking help can choose from smaller, locally-focused institutions, large regional players, and money-center giants. They can also go with business-focused lenders, a concept that Dallas-based Texas Capital Bancshares Inc. created when it was founded in 1998.

Finding the right banking relationship is a question of what the business and the bank each need.

Polling data show that, for the first time, it is more important to corporate leaders that bankers understand their companies than that banks be close by geographically, according to Hulsey.

“You see in polls that businesses really want flexibility and feeling in the relationship,” he said. “But banks must also have good digital [products].”

For banks to expand their businesses and avoid problems with regulators, they need corporate customers that combine growth potential with relatively few risks.

“When deciding who we’d like to work with, we first and foremost consider and evaluate the depth and quality of the company’s management and leadership teams,” said Rob C. Holmes, Texas Capital’s president and CEO. “Are they upfront and honest? Do they treat people fairly? Do they want a true partnership?”

Meeting Corporate Needs Through Specialization

Banks are increasingly offering new products and services that meet particular requirements of companies and entrepreneurs.

Texas Capital offers private wealth services. In January it announced the launch of an affiliated broker dealer, TCBI Securities, Inc., which helps clients with investment-banking needs like raising capital and securities underwriting.

JPMorgan Chase has increased its bankers’ industry specializations, according to Belen Garren, region manager in DFW for middle market banking and specialized industries.

“We see this as an important benefit for our clients and a differentiating advantage for our bank,” she said. “Our firm is able to provide local coverage with access to our global reach and that allows us to uniquely serve our [customers].”

Regions Bank offers an approach called Regions360, which involves surrounding clients with a team of experienced bankers from various divisions of the company, according to Brad Campbell, managing director, regional corporate banking executive.

The Birmingham, Alabama–based bank also has resources available such as asset-building lending solutions and equipment financing capabilities for growing companies, he said. “Regions Bank has made new investments in its business growth in Texas, and we have the experienced team and local commitment to understand what clients truly value.”

Banks Face More Competition

Excluding pandemic-related Paycheck Protection Program (PPP) loans, Texas banks’ balances from commercial and industrial lending rose from $68 billion at the end of 2020 to $76 billion and year-end 2021, according to Jill Cetina, a vice president in supervision at the Dallas Federal Reserve.

(Fed officials note that her views do not necessarily reflect those of her employer or the Federal Reserve system.)

“So adjusting for PPP loan forgiveness, Texas banks grew their business loans in 2021, but loan pricing reportedly has remained very competitive in light of the activity of non-bank lenders,” Cetina said.

Various business credit companies, which often are not FDIC insured, make loans to small businesses, according to Jacob Thompson, managing director at Samco Capital.

“They may be micro loans, smaller than traditional banks would do,” he said. “For big organizations, there may be private equity debt and mezzanine funds that have raised capital from investors and make loans to companies that need growth [capital].”

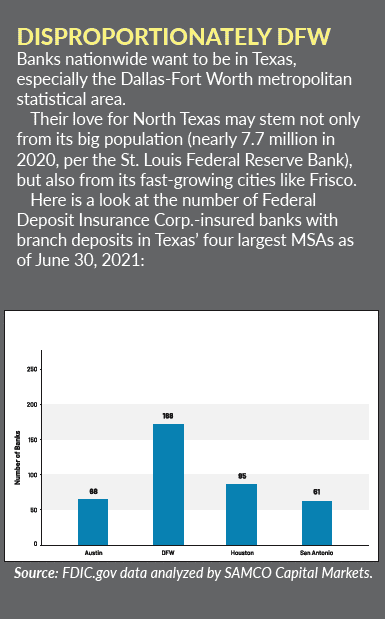

In addition to those rivals, banks from other states and countries have established Texas operations to take advantage of corporate relocations.

Lending Costs Rise

Another issue is surging lending expenses, the product partly of staff shortages.

“Texas banks’ noncurrent C&I [commercial and industrial] loans—past due 90 days or more or on nonaccrual status—totaled just $667 million at year-end 2021, down from $955 million at year-end 2020,” Cetina said. “So big picture, given exceptional official sector support to the economy during the pandemic, banks’ commercial credit costs have been quite low for the last two years.”

Rising wages, the result of increasing competition and a shrinking labor pool, are a more immediate challenge than inflation to employers in North Dallas Bank & Trust Co.’s market, according to Larry A. Miller, the Dallas-based firm’s president, chairman of the board, and CEO.

“At NDBT we have been able to continue to identify and hire willing and qualified bankers,” he said. “However, we are projecting a significant increase in personnel cost in 2022 over 2021. [This] is reflective of salary increases awarded as well as new hires planned. In my opinion, the number-one challenge facing our industry today is identifying and attracting willing and qualified employees.”

The good news, at least for lenders, is that the Federal Reserve in March raised its target interest rate, which is called the “federal funds rate.” This is what the Fed suggests commercial banks charge other institutions to lend excess cash overnight, according to Investopedia.

Kiplinger forecast on March 17 that the Fed will boost the federal funds rate six more times this year to combat inflation.

Texas Market Remains Strong

For now, banks are trying to help clients steer through problems like supply disruptions.

“We continue to work closely with all our customers to ensure they maintain strong liquidity and the right amount of inventory as cost increases occur,” said Brian Foley, Texas market president at Dallas-based Comerica Bank. “Most of our customers have been able to pass along these costs and continue to operate well so far, despite the inflation challenges we all face.”

Though it can be difficult for banks in this state to attract and retain employees and customers, the flip side is that they are getting opportunities from businesses that are moving here.

“Many of these companies are seeking new banking relationships when they arrive, and this has been a source of growth for Bank of Texas,” said Nurdin of the business’s Fort Worth region.

A number of banking markets across the United States are slow growth, and the only way for a bank to add market share in them is to take business from its rivals, according to Dan Bass, Houston-based managing director of investment banking at Performance Trust Capital Partners.

“In Texas there is so much business from new companies opening and moving [here] that you can grow organically without having to steal from your competitors,” he said.

The Future: Blockchain and Crypto?

Banks statewide are also kicking the tires on possible future opportunities from a pair of relatively new creations: blockchain and cryptocurrencies.

Since commercial banking is one of the nation’s most heavily regulated fields, many banks are taking wait-and-see approaches to blockchain as industry groups study it and the related regulatory implications. Blockchain creates an electronic record of one party’s payment to another at a given date and time.

“We’re just now exploring but are moving full steam ahead,” said Livvi Holland, vice president, marketing manager at Dallas-based Veritex Community Bank.

As with blockchain, banks are trying to get up to speed on cryptocurrencies and the rules and laws for handling them.

In June 2021, the Texas Department of Banking confirmed that banks chartered here can store customers’ virtual currencies as long as those institutions have adequate rules for managing risks and following laws.

For now, data does not show a large-scale diversion of banks’ deposits into cryptocurrencies, Bass said.

“I know banks are having many discussions with [financial technology] players that want to get into the financial services business,” Bass said. “Banks are looking to acquire fintech and being courted by fintech. So the industry is keenly aware of changes in the marketplace and is trying to stay in front of it.”