Launching New Growth Engines

Predictable revenue growth is one of the Holy Grails of the startup world, but it doesn’t just happen on its own.

Startups that get a product in the market with paying customers do a variety of things to boost their sales. After initial product-market fit is achieved and a repeatable customer acquisition model is discovered, the first growth strategy usually involves turning the crank faster and faster—in other words, doing more of the things that first proved successful for customer acquisition and associated revenue growth.

Of course, attempts at optimizing these initial activities can’t continue forever. At some point you will need to create new engines for growth. The purpose of this article is to explore the most common of those growth engines and offer a framework for helping you decide which is best for you.

Vectors

Before we get to the growth engines themselves, we must understand the vectors of a startup. In this context, a vector is either a product, customer target, geography, or use case. The combination of these vectors make up a big part of your go-to-market strategy. Let’s use my favorite imaginary case study, DoggieDrone, to make this more clear.

Product: A drone that can fly while tethered to a dog, and a mobile app that enables control of the drone for its stated purpose.

Customer Target: The elderly population who wish to continue aging at home, and who recognize the benefits of dog ownership but aren’t easily able to walk their dog.

Geography: The United States. More specifically, the states in which it is legal for low-flight drones to be operated autonomously while tethered to a dog.

Use Case: The drone walks the dog on behalf of the owner.

Exploring New Engines of Growth

Many pivots in the early days involve changing the customer target or use case after invalidating some initial assumptions about them. But a pivot usually doesn’t result in an additional customer target or use case. Instead, a better one is selected in order to achieve product-market fit and get the first engine of growth going.

This article, instead, relates to companies that have reached the point of either wanting or needing to add a new growth engine for their company. They might want to pursue this strategy because they generally have a good operational handle on things and see an opportunity to accelerate their growth. Or they might need to pursue this strategy because their original growth engine is either reaching its potential or encountering a phenomenon that causes it to not be as strategic or exciting as before.

Regardless of the motivation, achieving growth with this strategy involves adding something new to the original growth formula (adding to one or more of the vectors). This means adding a new product, a new customer target, a new geography, or a new use case. This introduces so much risk that usually only one new attribute is added at a time, not multiple.

Let’s explore a possible growth engine around each vector, and its associated considerations.

New Product

This growth strategy involves creating and selling a new product to the same customer. When implementing this strategy, seek synergies with existing products for the best cross-sell potential. It’s ideal if the same customer acquisition and support methods work well for the new product too. Adding a second product also enables a land-and-expand sales strategy, whereby one product is used to acquire a new customer and revenue is later expanded with that customer by cross-selling the other product.

DoggieDrone Example:

The company could design and introduce the RoboScoop, a robotic pooper scooper that follows the dog while it’s being walked by the drone. It takes care of business after the dog’s business is done, and returns it home in a compartment that’s lined with a small plastic bag for easy disposal.

New Customer Target

This growth strategy involves selling the same product to a new type of customer. The new customer could be different in size, demographics, industry, or several other attributes. And because the customer is different, new messaging and positioning will be needed that is unique to the new customer. Awareness campaigns, pricing, and competition might also change.

DoggieDrone Example:

The company could start targeting upper-middle-class households in which both parents work. They have the money to spend on something like DoggieDrone. Additionally, both their weekday morning and evening routines for themselves and their kids make dog walking a major inconvenience.

New Geography

This growth strategy involves expanding your customer acquisition model geographically, which could mean new cities or regions in your home country, or new countries altogether. Expanding into new countries carries significant implications and risks, which should not be taken lightly.

DoggieDrone Example:

An obvious geographic expansion opportunity is US states that pass new legislation making this type of drone flight legal. But rather than wait for that to happen organically, the company could spend money on lobbyists to help accelerate the law changes. The company could also take on the riskier option of expanding into an international market where drone use laws are already in their favor.

New Use Case

This growth strategy involves new applications for the same product. Implementing this means one or more of the company’s other business plan elements will probably need to change. That means messaging, pricing, customer acquisition, support strategy, etc.

DoggieDrone Example:

The drone could be enhanced to follow a family’s son or daughter as they walk or ride their bike to the elementary school in the neighborhood, providing a live video feed and an alert if the child stops or veers off the logical path.

What About New Routes-to-Market?

A route-to-market (RTM) is essentially a channel or method used to acquire new customers. Common examples include self-service (i.e., ecommerce), direct sales, distribution partners, and licensing partners. Some of these are considered direct routes, which involve you selling directly to your customers, while others are indirect routes, because they involve some intermediary between you and your customers.

Adding a new route-to-market to your customer acquisition strategy could absolutely serve as a growth engine. The reason I didn’t include it in the original list of vectors is because adding a new route-to-market doesn’t usually increase the total available market (TAM). It could, however, increase the serviceable available market (SAM), meaning it can serve as a growth engine.

The main thing to be careful of when adding a new route-to-market is accidental competition between customer acquisition methods. In other words, if you have both a direct sales team and reseller partners selling into the same market, they will compete with each other. This is referred to as channel conflict and it is a royal pain to deal with. To minimize, or eliminate, the risk of channel conflict, segment your markets in such a way that unique routes-to-market are deployed for the various segments. Below are some examples:

- Direct sales in the United States. Distributors in foreign countries.

- Direct sales for Product A. Resellers for Product B.

- Direct sales for enterprises (needs to be defined). Resellers for small-to-medium businesses (needs to be defined).

- Direct sales for Industry A. Licensing partners for Industry B.

You might notice that the segmentations are along the lines of the original list of vectors (product, customer target, geography). This should also give you the hint that launching a growth engine via adding a new vector also gives you the opportunity to decide if an existing route-to-market should be used or if a new one is better suited to achieve the desired growth results. Just remember that adding a new route-to-market will introduce new complexities and associated risks.

about matters like launching a new growth engine for your company,

but it should augment, not replace, the executive team dialogue.

Deciding Which Growth Strategy Is Best

I like to do a lot of evaluation of the synergies between a given growth engine and the current business model. The reason I like this framework is that it helps ground strategy discussions with the executive team. It gives them a methodical approach and allows them to evaluate not just the opportunities that open as a result of adding to a vector but also the risks and implications to the company. It’s easy to get excited about an expanded market size but ignore what needs to be created or changed in order to properly pursue that strategy.

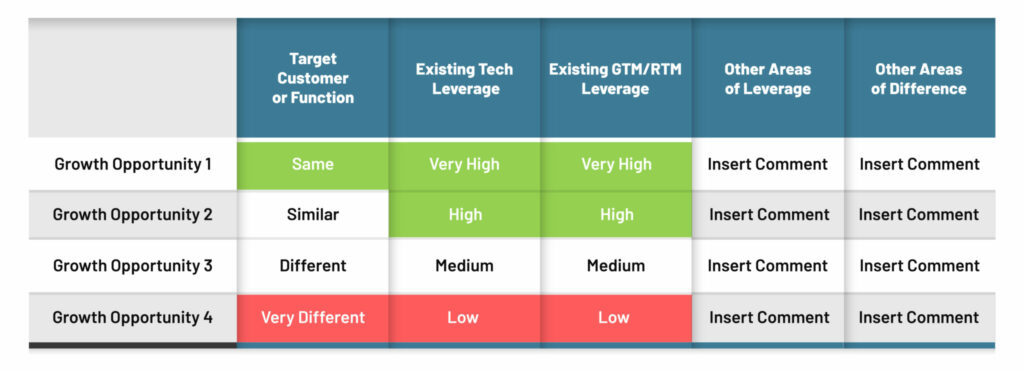

If you have two or more potential growth strategies you want to implement next, consider comparing them side by side along multiple attributes—things like leveraging existing core technologies, routes to market, pricing strategy, support model, revenue recognition accounting, and the like. The more synergies that exist, the less you’ll need to create from scratch. And that means less risk overall and more ability to focus on a smaller subset of new factors within the company.

But even if you want to make a fancy, color-coded, and scored comparison grid, realize that critically important matters such as launching a new growth engine for your company shouldn’t be relegated to color codes or mathematical scores. The discussions and debates you and your executive team have will best inform you. This article and the table below are just tools to help foster those discussions and debates. Additional columns could relate to pricing strategy, support model, revenue recognition (or financial accounting), tech stack, hosting infrastructure, and the like. You can decide where the important synergies might be different amongst the growth opportunities.

When I think back to my personal experiences with launching new growth engines, they mostly locked in the target customer and involved introducing new products for that same customer. The new products either expanded the existing use case or introduced new ones that had synergies with the original product(s). And I must say that customer intimacy is a powerful attribute for any company to leverage. Don’t underestimate how hard it is to really get to know a new type of customer.

One company I worked for that experienced very impressive growth had at least five products, all sold to the same broad function within large enterprises. The products had technical integrations between them that offered a fabulous land-and-expand strategy. A typical first deal size was about $150,000, but with reasonable potential to grow to $1 million or more over the next few years. The company was acquired by a Fortune 500 company for $200 million.

• • •

Startups that demonstrate consistent and aggressive growth earn the best valuations and are best able to maintain a leadership position in their market. But accomplishing this is so much harder than most first-time founders think. This article provides just one piece of the growth strategy puzzle. Additional emphasis on achieving scalability (covered in the Q3 2021 issue of Texas CEO Magazine) is required in order for the organization to sustain periods of aggressive growth that last longer than a blip.