Don’t Confuse Growth with Scalability

I often hear startup founders say things like “We want to scale” or “We scaled a lot in the past six months.” In most cases, they should have used the words grow and grew instead of scale and scaled. That’s because growth and scalability are two very different things. They are certainly related, with one being dependent on the other in certain situations, but that doesn’t mean they are synonymous.

The savvy entrepreneur understands the difference between growth and scalability. This does more than help them avoid the linguistic mistake above. It can also help them see how these separate but intertwined concepts operate in their own startups, and better prepare for real and sustainable future success.

As we tease out the difference between these two concepts, let’s look first at growth, including some common misconceptions about what it takes to grow to the $100 million benchmark. We will then turn to scalability, including some tools that can make your startup more and truly scalable.

Growth

Growth is something a company experiences, or desires to experience. It’s usually reflected in a financial metric like revenue, or sometimes in an operational metric like newly acquired customers. Many companies raise multiple rounds of funding and put lots of energy into customer acquisition and partnership strategies, primarily in order to achieve a high rate of revenue growth. This high rate of growth, especially in the initial phase, signal to investors and the world at large that the startup is on its way to bigger and better places.

As a company matures, continuing to grow revenue at an exciting pace often requires expanding along one or more elements of the business plan. The most common such strategies include creating new products, targeting new types of customers, and expanding into new geographies. Each strategy comes with considerable implications and trade-offs. But in order to create an exciting exit outcome in the future, the underlying strategy is the same: grow, grow, grow.

The Mystique of $100 Million

100 million is a nice big and round number, almost no matter what is being counted. It’s also a very respectable revenue figure for almost any company to reach, because—at least in the minds of the founders—it might lead to a unicorn valuation (a valuation of $1 billion). The problem is, $1 million in revenue is not at all easy to accomplish.

What if I gave you a full 10 years to reach $100 million in revenue, from the day you scratched out a skeleton business plan on a napkin? That’s plenty of time, right? Especially if you have a great product idea, a huge market, and a solid team. In fact, we all know several examples of tech startups reaching that figure in considerably less than 10 years. So why couldn’t that be you? Of course, it could. It’s just much more excruciatingly difficult than most think.

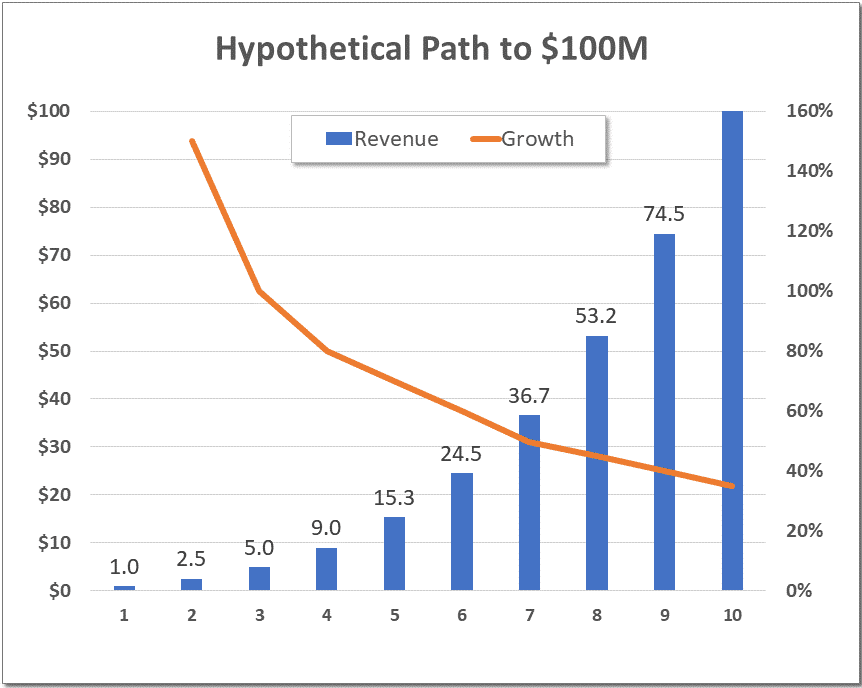

Below is an example of a hypothetical growth path to $100 million over a 10-year period, including year-over-year growth percentages; next to it is that growth path in chart form. Imagine how much more difficult it would be to achieve the $100 million target in five or six years.

Year 0 — $0.0M

Year 1 — $1.0M

Year 2 — $2.5M (+150%)

Year 3 — $5.0M (+100%)

Year 4 — $9.0M (+80%)

Year 5 — $15.3M (+70%)

Year 6 — $24.5M (+60%)

Year 7 — $36.7M (+50%)

Year 8 — $53.2M (+45%)

Year 9 — $74.5M (+40%)

Year 10 — $100.6M (+35%)

In this scenario, achieving growth rates in excess of 100 percent in the early years certainly can happen, especially since the company is starting from a relatively small base. In fact, probably the easiest way to grow to $100 million in less than 10 years is to post growth rates in the 200–500 percent range in the first couple of years. But I actually see many startups take three years or more just to reach the $1 million milestone, due to needed pivots, fundraising difficulties, cofounder funk, and a long list of startup trials and tribulations.

Even though the hypothetical path involves decreasing growth rates over time, you should understand that continuing to deliver 50–80 percent growth rates in the middle years, and even sustaining 35–45 percent growth in the last couple of years, is so amazingly difficult that it’s hard to describe to someone who hasn’t been in that movie before.

Triples & Doubles

You might have read about the strategy of tripling revenue for a couple of years, then doubling for a few more. Introduced by an investor named Neeraj Agrawal, this “triple, triple, double, double, double” (TTDDD) strategy is somewhat well known within venture funding circles. If you started with $1 million in revenue and achieved the TTDDD growth rates over the following five years, you’ll reach $72 million. Amazing, but also amazingly difficult to achieve.

If, instead, you only triple once and then double each year from there (i.e., TDDDD), the result is still very respectable, but a much lower $48 million. In fact, if you don’t start with a triple, but rather just double each year (i.e., DDDDD), the end result is only $32 million. These alternative examples demonstrate the positive impact of super-aggressive growth rates in the very early years.

Scalability

Rapid growth is different from scalability. As mentioned before, growth is either an aspiration or something a startup actively experiences. Scalability, on the other hand, is a capability that may or may not ever be exercised, even if it does exist. This is why it makes much more sense to say “Our company grew” than it does to say “Our company scaled.” An entrepreneur doesn’t scale a company, but they can make it more scalable—i.e., more prepared to grow rapidly.

Here’s another way to think about it. Scalability directly influences whether your company is able to handle sustained periods of growth. To determine how scalability might translate to your company, ask the following question: What do we need in order to fully exploit sustained periods of rapid growth, with minimal risk and disruption to our company?

Going into an all-hands-on-deck mode is one way of getting through periods of rapid growth, but it comes at a cost of disrupting all sorts of things that are surely strategic or important. Worse, you can’t live in this mode for very long without severe employee burnout, costly mistakes, and other negative consequences. It’s really only good for short blips. Thus, going into all-hands-on-deck mode isn’t a true form of scalability.

When it exists, scalability is architected in and commonly reflected in the back-office functions or the technical architecture of the product solution. In other words, scalability is primarily present not in the exciting stuff like marketing campaigns and sales plans, but rather in the plumbing of the company.

One set of back-office functions that can impact scalability is recruiting, onboarding, and training. Imagine that you suddenly needed to dramatically increase your number of employees in a short period of time to respond to a super-aggressive growth opportunity. During the startup phase, this might mean growing from five to 35 employees in six months. Later, it might mean growing from 75 to 200 employees in a year. In either case, do you have the strategy, tactics, and talent to recruit, onboard, and train this onslaught of new employees? If not, your desired aggressive growth rates might become impossible to achieve. You didn’t have enough scalability.

Another example involves transaction processing, customer onboarding, and support. Imagine an exponential increase in the number of new customers in a short period of time. Do you have the strategy, tactics, and talent to keep your books in order while offering the new customers quick time-to-value and a positive overall experience? If not, once again, you lack the scalability to handle the growth you would like to experience.

These two examples might cause you to conclude that you should overstaff your startup and implement systems in the early days that are ready for your needs once you become a $100 million company. That is definitely not the case. Instead, it’s wisest to implement systems and processes that have some reasonable ability to accommodate rapid growth without having to be replaced. If you can predict where you would break during aggressive growth, you can also identify the systems and processes that can most contribute the needed scalability.

Also pay close attention to the leadership talent you bring into the identified functional areas. Do these leaders know how to architect and implement scalable systems and processes? Have they worked for a company that experienced rapid growth and/or one that was at least a few years down the road from where you are today?

Most of the back-office functions, although they are key strategic cogs in the scalability wheel, aren’t as exciting or outwardly visible like the product or sales and marketing activities are. I find they often therefore take a far back seat to everything else when it comes to funding, hiring, and general attention. Once you understand the real nature of scalability, you can avoid this trap. Trying to achieve true scalability after you have already hit an exponential growth curve is extremely painful. Instead, spend strategy and planning time on becoming scalable before happens.

Thinking One Step Ahead

As you build scalability, consider using this tool: Act and operate as if you were one major step ahead of where you are today. For example, when you reach $1 million in revenue, start acting and operating as if you were a $2 million company. Once you’re at $2 million, act and operate like a $5 million company. You get the idea. This philosophy doesn’t need to stop until you reach hundreds of millions of dollars and are publicly traded. This tool can help institute just enough scalability to prepare you for the next big milestone, across all functions. Give it a try.

Where Would You Break?

To help think about the operational implications of being scalable, consider asking yourself questions like the following:

- If our business tripled next quarter, where would we break? What could we do to prepare for it (tools, processes, people, etc.)?

- If we decided to dramatically expand our geographic footprint, where would we break? What could we need to do to prepare for it?

- If we suddenly closed a huge funding round and the investors wanted us to immediately shift from third gear to fifth gear and loaded with jet fuel, what would that mean from an operational standpoint?

• • •

Now that you have a clear conception of the difference between growth and scalability, you can better prepare for the former by enhancing the latter. And you’ll know not to say things like “We’re going to scale next year.” Much more accurate instead to say what you mean: You’re going to work on your scalability to be ready to grow like a rocket ship with minimal disruption.

Major Milestones Along the Way to $100 Million

Growing to $100 million obviously requires regular revenue advancements every month, most of which are small and unnoticeable. It’s like a parent watching their kid grow up. Week-by-week changes aren’t noticeable, but if the grandparents only see the child once per year, they are amazed at how much has changed since their last encounter.

Following is a description of the path to $100 million, focusing on four major milestones along the way: $1, $1 million, $10 million, and $100 million. For each, a set of suggested critical success factors for reaching the milestone is described. There are obviously many other things that need to happen in order to accomplish the ultimate goal, but the main point of the exercise is to see how dramatically different the required actions and accomplishments are for reaching each milestone.

I’ve tried to avoid suggesting actions and accomplishments that are unique to a specific type of company, which means you might need to adjust some for yours. For example, there are differences between hardware, software, and service companies, and the same for companies that serve consumers versus companies with large enterprise customers.

Getting to $1

- Identify a problem that truly needs to be solved

- Develop a product or service that solves the stated problem

- Learn how to advance forward with little financial resources

- Recruit other driven team members who share a common passion

- Find someone who is willing to either pay for the product or pay for some attribute related to the product’s usage

Getting to $1 million

- Recruit quality team members into specific functions

- Carefully institute a set of founding principles that will later influence the company’s culture

- Maintain a high degree of focus on a single product for a single market, accessed with a single go-to-market strategy

- Implement a repeatable method of acquiring customers or users

- Refine pricing such that it ties to customer value and supports efficient customer acquisition

Getting to $10 million

- Implement an effective management system for making decisions and setting priorities

- Cultivate a strong, positive company culture

- Institute processes for employee engagement, professional development, and performance management

- Expand along one or more of the following dimensions: product offerings, geographies, industry verticals, application use, buyer personas, target company size

- Activate one or more strategic partnerships that provide positive leverage along some important dimension

Getting to $100 million

- Recruit executive talent with large company experience and empower them to run their functions with very minimal oversight

- Implement robust strategy and planning processes with a longer-range horizon (two to three years)

- Replace most operational systems and tools to support the company’s larger size and increased complexities

- Further expand along one or more of the following dimensions: product offerings, geographies, industry verticals, application use, buyer personas, target company size

- Avoid becoming inflexible and irrelevant in light of smaller competitors with more innovative solutions and much larger competitors with seemingly unlimited resources

1 Comment

Great article. Very helpful. Thank you.