The Seed Fundraising Dance – Startup Success: A Startup Fundraising Series

Convertible securities—a form of investment that will later convert into a different form of investment—are by far the most popular fundraising instrument used for seed funding rounds of $1 million or less. But in addition to coming with unique terms and mechanics, convertible securities also introduce an interesting phenomenon referred to as the rolling close. And it’s the rolling close that causes the seed fundraising dance I will describe in this article.

Attributes of the Rolling Close

Here is how the typical rolling close works: As each investor (most often an angel investor) commits by signing the convertible security, they can transfer their funds and the fundraising startup can immediately put those funds to work. This is very different from equity rounds of funding, which have one or more official close dates with minimum threshold amounts that must be met before the startup gets access to the new funding.

The rolling close is a double-edged sword. On one hand, being able to gain access to new funding as the commitments are made allows the startup to immediately put the increments of new capital to work. On the other hand, if the commitments are spread out over several months, it can create a hand-to-mouth scenario that never lets the company really make the intended investments and commitments. A rolling close also introduces the risk of closing some investors in the starting phase of the fundraising campaign, only to later discover that the terms aren’t attractive enough to fill out the rest of the funding round. Because of this, the risk profile for investors during the rolling close changes quite dramatically throughout the phases of the fundraising campaign.

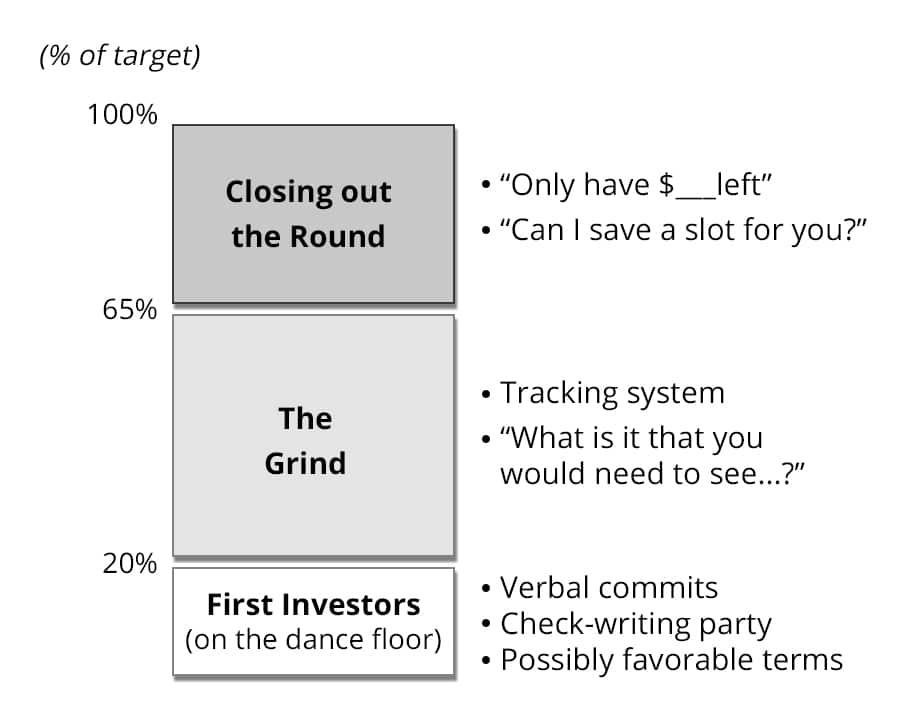

Securing the First Investors

The first 20 percent or so of the target funding amount is by far the hardest to close. Think about it from the investor’s perspective. If a startup has a target to raise $1 million and an investor writes the first $50,000 check, what happens if the company isn’t successful raising any more funding? Their investment is basically dead on arrival. So instead, if they like the investment opportunity, they will want to write the last $50,000 check, after the company has already reached $950,000. The first investments in the funding round are the riskiest, and conversely, the last investments are the least risky.

Investors pitched during the starting phase won’t usually come right out and say they don’t want to be the first investor. Instead, they will give another homework assignment, ask for another meeting to dive into a different part of the business, or otherwise find ways to drag things out in hopes the startup will raise some money from other investors first. But if no investor is willing to write the first check, how can a startup ever get a seed round closed? Here are two ideas.

Favorable terms

If the very first investors in the round are taking more risk, should they get the exact same terms as the last investors in the same round? The flexible nature of convertible securities allows varying the terms, as necessary, for situations like this. Essentially, a startup could offer more favorable economics to the first investors to help offset the additional risk they are taking.

The favorable terms are often aligned with the first 10 to 20 percent of the target amount for the round. For example, for a startup raising $1 million in total, the first $100,000–$200,000 worth of investment would come with more favorable terms.

Verbal Commitments

A second tool for getting some first checks written is verbal commitments. Fundraisers can use this instead of, or in addition to, favorable terms. It basically involves asking the first highly interested investors to initially commit only verbally. In other words, if they seem to have decided to make an investment but aren’t reaching for their checkbook, they are asked if they can be considered verbally committed and asked what they will need to see before they will write their check. Most likely it’s raising a certain amount from others first. It is really important to understand what bar needs to be reached to secure their follow-through.

The first verbal commit is used to help secure the second one, and so forth until reaching the bar to have a virtual check-writing party. This sequential process is dramatically enhanced if the committed investors will allow their name and committed amount to be shared with other prospective investors.

Entering the Grind

After closing the first part of the seed funding round, there’s no way to best describe the next phase other than a true grind. The mission during this middle phase is to reach a genuine downhill slope for the round. I’m talking about something in the range of 65 percent of the total target. Whereas the starting phase involves selectively finding the first movers, this middle phase involves tons of meetings and often tons of disappointment along the way to that 65 percent.

By now, the prioritized target investor list should be robust. And with the first investors closed, the fundraising founder should know who to go after next. In fact, there should be some investors who previously gave clear indications of interest but specifically rejected the attempts to close them using favorable terms or verbal commits. With the first chunk of the round closed and with money in the bank, those are the best investors to approach again.

The most significant asset for this middle phase is pure hard work and a positive attitude. But there are a couple of other tools to use. One is a system for tracking and managing investor interactions. Grouping investors in ways that make the most sense (possibly by their assessed odds of investing), capturing information to remember about the conversations, and recording logical next steps are all important to reduce the chaos. Most fundraisers just use a spreadsheet, with color-coded text and highlights to visually assist with the sheer volume of information.

If you want to figure out why a particular investor won’t give their commitment, you can use my favorite question for this purpose: “What is it that you would need to see in order for this to be an exciting investment for you?” Variations of this question break the cycle of the investor repeatedly asking for another meeting or issuing another homework assignment just because they either can’t make a decision or already know they won’t invest but simply don’t want to say so. To either of those requests, the fundraiser can reply, “Sounds good. So, in addition to [fulfilling their follow-up meeting or homework request], is there anything else you will need to see in order for this to be an exciting investment for you?” Grind, grind, grind until you get to 65 percent of the fundraising target.

Investors should be assumed to have attention deficit disorder, whether it’s true or not. Active investors see lots of deals. If they seem really excited by the end of one meeting, that excitement has an extremely short shelf life. It wears off unbelievably fast, and that’s partly because of the other exciting investment opportunities they come across shortly thereafter. Sharing progress on traction is always the best way to remain top of mind with investors who have short attention spans.

Closing Out the Round

Finishing the final 35 percent of the fundraising target is not easy; it just won’t be as chaotic. Upon entering this phase, the messaging about fundraising progress should absolutely change. Whereas previously the amount closed so far is usually mentioned to new prospective investors, reaching this last phase allows messaging about the scarcity, the amount to be closed. For example, “We’re raising $1 million and only have $150,000 left. Can I save you a slot?” What, there might not be a slot left to invest if I don’t move quickly? That’s absolutely the desired reaction from the potential investor. If there is good fundraising momentum upon entering this final phase, this tactic will typically play out to the fundraiser’s great advantage. If, instead, they barely limped into this final phase, they probably won’t get the desired reaction.

Getting Stuck

The rolling close scenario that causes the most frustration and confusion typically looks like this: The fundraiser has gotten through the middle phase but does not have enough of a pipeline of interested investors to fully close out the round. Most often, I see fundraisers getting stuck somewhere around 70 percent of the original target. This situation represents a dilemma, in that the ultimate goal is within sight, the effort required to get to 70 percent was significant, and forfeiting the missing 30 percent of funding changes the expected outcomes enough to make a meaningful difference. Founders find themselves not wanting to give up. That is admirable but may not be the best decision.

A founder in this situation might be inclined to dial fundraising efforts back to 30 percent of their time so that energy can be put back into the business. After all, the cofounders and coworkers have been picking up their slack since fundraising was dialed up to 80 percent. But in truth, the best approach is to first step back and closely assess the situation to decide whether fundraising should remain a priority or if it should be stopped altogether. Anything in between is going to result in huge disappointment. Dialing fundraising down to 30 percent will result in little fundraising success, yet will still put the business results in some jeopardy. It’s a lose-lose situation.

As for assessing the situation, there are a few things to be scrutinized very carefully. After doing so, it will hopefully be clear whether it’s best to remain fully engaged or to pause the fundraising efforts. I say pause rather than stop because certain conditions could exist in the near future that cause resumption of the efforts, and the flexible nature of convertible securities is very supportive of that situation. Here are three of the factors to scrutinize before making the decision on whether to pause or keep pushing.

Investor pipeline

If the investor pipeline has run completely dry or if only poor-quality investor prospects remain, the answer is clear. Fundraising should be paused, because spinning up fresh investor prospects is going to take too long and too much energy.

Common investor concerns

If there are common themes or issues voiced by investors, the fundraiser should evaluate the time and effort needed to solve them. Being able to easily or quickly solve a small number of issues that, once addressed, will reliably unlock additional investment might be enough justification to continue the campaign. Otherwise, fundraising should be paused.

Need for the remaining additional capital

Time has gone by since the fundraising campaign started, which means the startup should be smarter about their business venture. Some assumptions in the business plan might now be validated, and some of the original financial projections might have been too conservative. In other words, the startup might not absolutely require the full original fundraising target in order to achieve enough outcomes to successfully raise their next round of funding. Of course, the opposite could be true, which leaves them even more desperate to close the remaining funding.

• • •

Fundraisers who follow the recommendations and best practices that we have covered so far will not only be better seed fundraising dancers, but they’ll end up with a couple of extra zeros on their bank account balance. While doing the dance, they’ll be thrown a few curveballs by investors amid being asked some of the same questions over and over again. In my article in the next issue of Texas CEO Magazine, we will further improve those dance moves by diving into best practices for investor interactions.

1 Comment

How can i get contacts for seed funding