Texas Economic Indicators

Texas economic activity accelerated and dining out and consumer spending continued to rise in September. While job growth picked up, sentiment remained pessimistic, according to the Texas Business Outlook Surveys. Here is a closer look at these and other economic indicators.

Labor Market

Texas Employment Growth Resumes

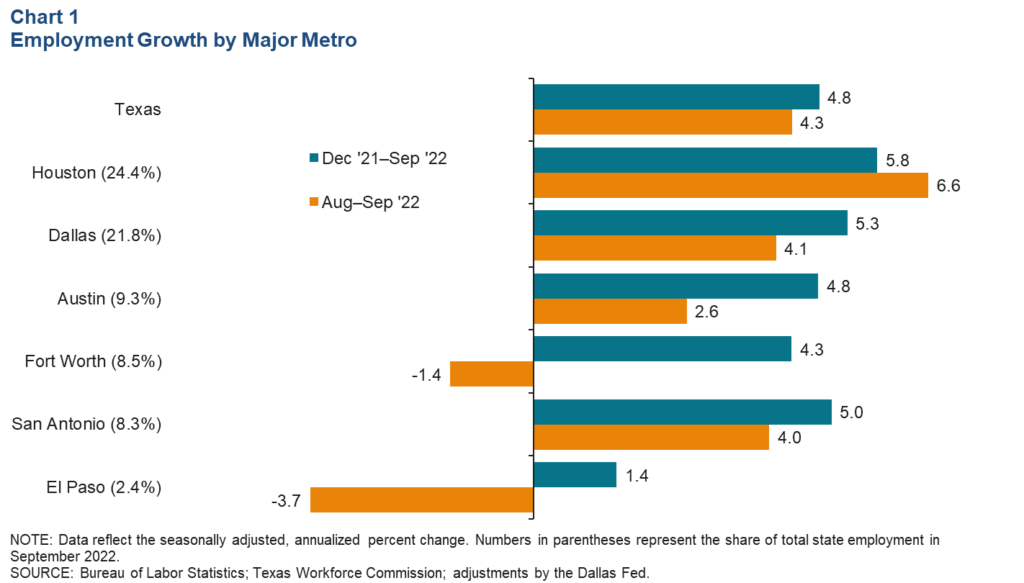

Texas employment expanded an annualized 4.3 percent in September after posting no growth in August. Most major Texas metros saw strong gains, except for Fort Worth and El Paso. Houston took the lead at 6.6 percent. Payrolls climbed an annualized 4.1 percent in Dallas and 2.6 percent in Austin. Year-to-date employment growth in nearly all Texas metros was positive. The Dallas Fed’s Texas Employment Forecast is for 4.4 percent growth this year (December/December), up from 4.2 percent in September.

Texas Business Outlook Surveys

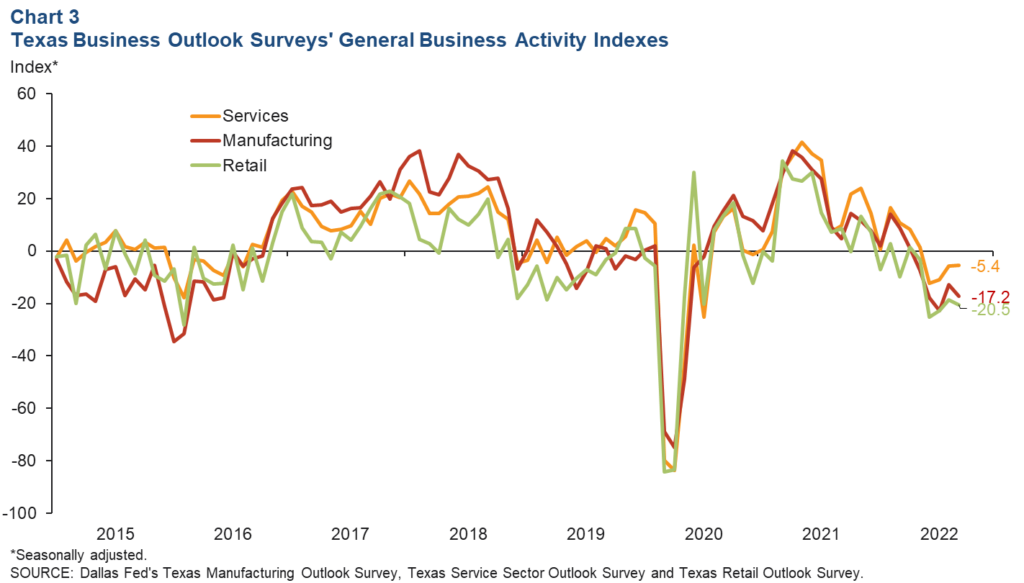

Perceptions of broader business conditions remained negative in September’s Texas Business Outlook Surveys. The general business activity indexes for the manufacturing and retail sectors were negative for the fifth consecutive month. The manufacturing business activity index dipped 4.3 points to -17.2, while the retail index fell 1.9 points to -20.5. The service sector business activity index was negative for the fourth consecutive month and held steady at -5.4.

Dining Out

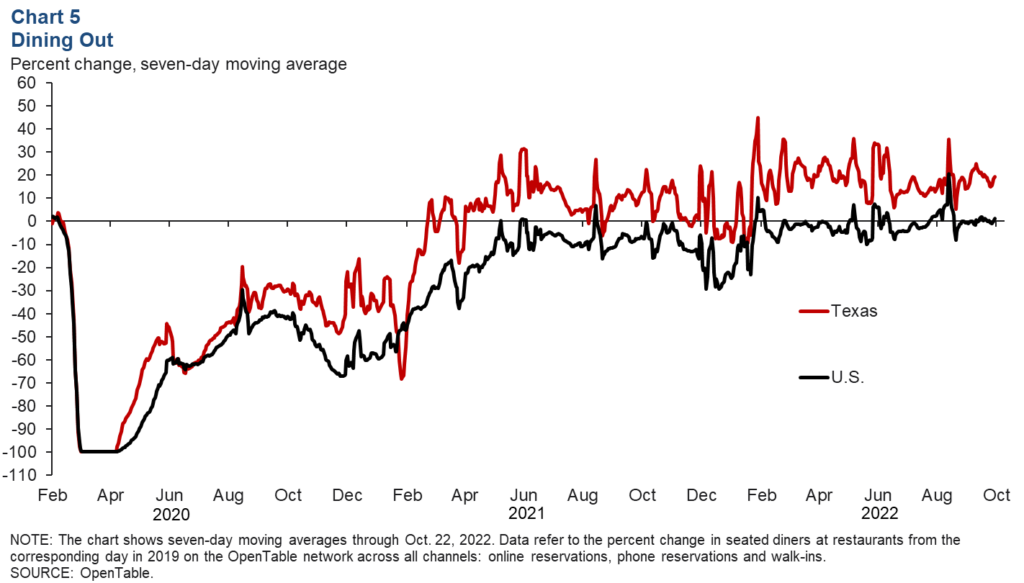

The number of seated diners at restaurants across the OpenTable network remained at or above 2019 levels both statewide and nationwide, based on a seven-day moving average. The US figure moderated throughout October and was 1.2 percent above 2019 levels on Oct. 22. The Texas figure was above 2019 levels for the 36th consecutive week, reaching 19.4 percent above the benchmark on October 22. Austin led major Texas metros at 32.1 percent above 2019 levels. Dining out was up 17.7 percent in San Antonio and 7.2 percent in Houston. Dining-out levels in Dallas have been consistently at or below 2019 levels since September 1 and are currently 3.8 percent below the benchmark.

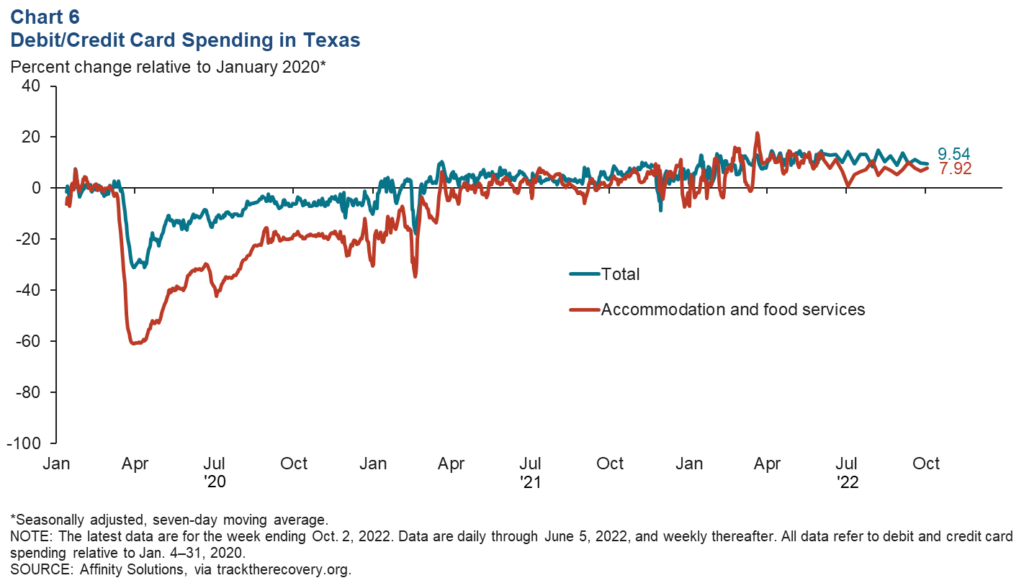

Consumer Spending

Relative to January 2020 levels, consumer spending in Texas continued to increase amid high inflation. As of the week ending October 2, total debit and credit card spending was 9.5 percent above January 2020 levels. Accommodation and food services spending rose to 7.9 percent above January 2020 levels.