Startup Success: A Startup Fundraising Series

How Much Should We Raise?

For most startups, the decision to raise money is made out of necessity. The entrepreneur needs more funding to continue pursuing their dream, whether the money will be used just to survive a while longer or truly shift a gear and move into the next stage of evolution.

Other startups pursue funding out of want more than need. Usually, this is because they either want to get more aggressive in their growth or because there’s some opportunity they want to exploit sooner than when they might otherwise organically. These startups are in the fortunate position of turning down the funding if the terms, timing, or amount isn’t right.

But regardless of whether the entrepreneur is pursuing funding out of necessity or desire, they still face a difficult decision: how much to raise. Not only is the decision critical to the startup’s own planning and forecasting, but investors will want to understand why the entrepreneur has chosen to raise the stated amount of money. The ability to demonstrate that they determined the right amount of funding for the company at its particular stage is important for establishing credibility with the investor. The entrepreneur will essentially become the steward of the investor’s money through multiple rounds of funding, until they eventually exit and the investor gets a return. Thus, the investor needs to see a cohesive fundraising strategy that doesn’t just let the startup survive for a while longer but rather allows them to reach future key milestones for continuing to get funded and eventually grow a great company.

Investors typically get a lot of unacceptable responses when they ask why the desired amount of funding is the right amount, such as “Most other startups at our stage seem to raise that amount,” “It’s the most we think we will be able to raise,” “It only dilutes us 25%,” and “It gives us one year of runway.” These responses might be true, but they are all also terrible. This article provides a framework for determining how much a startup should raise and how they should describe that to investors.

The Basic Formula

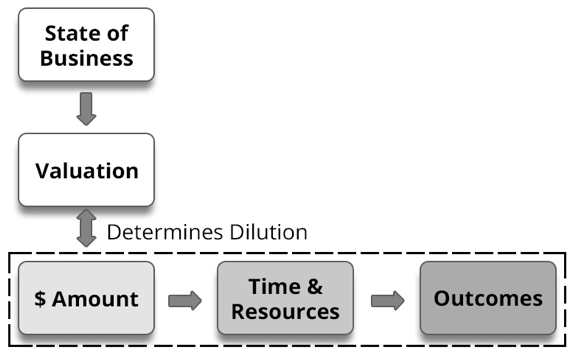

For startups seeking growth, the figure below summarizes the first major steps for deciding how much to raise. As you can see, the amount of money raised affords the startup a combination of time and resources. And with time and resources, they can accomplish things (outcomes).

The basic concept is simple. And since we are trying to solve for the right amount of funding to raise, let’s analyze the other variables a little further.

Time and Resources

When I say time, I actually mean an amount of time the money will last, or what is often referred to as runway. The amount of runway needed varies widely for each venture but usually gets longer with subsequent rounds of funding and later stages of evolution.

The most obvious type of resource is the one every founder obsesses about, additional headcount—regardless of whether they are part-time or full-time. “If we only had two more developers, we would be in great shape.” In the same category as headcount are contractors, consultants, and various service professionals like lawyers and accountants. What many early-stage startups don’t think about are things like increased spending for marketing programs, specialty tools, and software systems. These are usually important resources that are also needed to advance the business.

For startups, time and resources are in competition with each other. In other words, a startup could use all of the new funding to gain time, but that means not adding headcount to the team, not adding more contractors, and not spending more on programs, tools, and the like. Instead, they could use all of the new funding to aggressively dial up headcount and spending, but that means they’ll almost immediately have to raise more money. Part of the trick is dialing in the optimal combination of extra time and extra resources in order to achieve the desired outcomes.

Figuring out the best combination involves creating a financial forecast model that allows experimenting with various assumptions and alternatives. For a pre-seed or seed round of funding, the startup will have lots of assumptions that have no support from prior results. Because of this, the investors will really want to understand any information or insights they have to support their assumptions. Later, the prior track record will serve as a basis for many of the projections.

Outcomes

Outcomes are discretely identifiable results the startup hopes to achieve with their newly raised funds. How about acquiring a certain number of new customers to reach the next meaningful revenue milestone or significantly reducing your average cost to acquire a new customer? How about securing a strategic partnership that will provide significant leverage or getting final approval on a patent filing? What about launching a new product or entering a new market? These are outcomes that reduce the investor’s risk or increase their upside potential when the startup eventually exits.

The best way to understand the formula is the way it is diagramed above, left to right. But the best way to actually go about the exercise of figuring out how much money to raise is to work backward, starting with the desired outcomes. It is those future outcomes that the investors want the company to achieve and, therefore, the things they want to fund. Once the desired future outcomes are determined, the startup simply needs to use their financial forecast model to determine the best combination of time and resources needed to generate the outcomes. With this, they can determine how much funding is needed for that combination of time and resources.

There are pretty dramatic differences in the outcomes Silicon Valley investors expect and the outcomes investors in most other places in the country expect. A set of projected outcomes that are exciting to an investor in Memphis, Tennessee, or Denver, Colorado, could easily seem way too safe and conservative to a Silicon Valley investor. There is much more of a swing-for-the-fences, build-a-unicorn, global-world-domination mentality in Silicon Valley, and fundraising startups should understand this philosophical difference in risk tolerance as they go about setting their desired outcomes.

Why not just raise enough money to last a long time, like three or four years? Well, ignoring whether the startup could be successful raising that much, the answer relates to the valuation they’re able to negotiate with investors.

Time for the First Check and Balance

Let’s assume $10 million would fund a particular venture for four years. The question is, What sort of valuation can the company earn at the time they raise that money? As you can see in the figure below, today’s valuation is mostly based on the state of the business today. If investors will only agree to a $5 million valuation, for example, the company will experience significant dilution and immediately give control to the investors due to the amount of equity they will get. The amount of money raised compared to the valuation they’re able to negotiate provides a check and balance.

Because of this, the process of figuring out how much money to raise is often iterative. First, an uncontested look into the crystal ball allows the startup to figure out how much to raise in order to accomplish a desired set of outcomes. Next, a test-drive with investors helps inform whether the valuation they’ll be able to negotiate derives reasonable dilution or if they’ll need to adjust the amount, either up or down. If they adjust the amount down, the significance of the projected outcomes will also be adjusted down. That might cause the round of funding to seem less exciting for investors, and an adjustment may be necessary. These iterations continue until the startup find the right balance of outcomes and valuation.

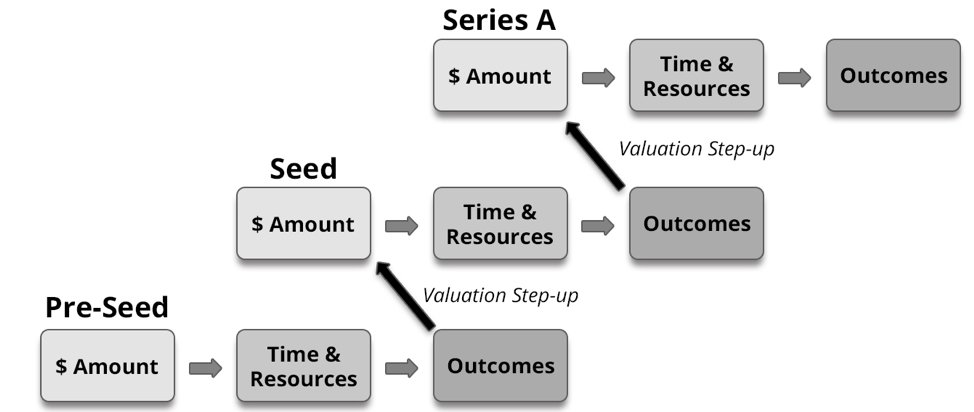

Multiple Rounds Over Time

Now that you understand the basic formula and framework, let’s project forward to see how multiple funding rounds tie together. As you can see in the figure below, with each round of funding, the projected outcomes eventually become the state of the business in the future. That is what the company uses to gain the desired step-up in valuation for the next round of funding. This cycle continues again and again until the company is either self-sustaining or experience an exit (acquisition or IPO).

Evolving from a bootstrapped startup to a funded one is a big and important transition. A startup might end up as a funded one out of need or want. If they don’t need funding, then they have alternatives. Most startups eventually need outside funding and, once that happens, many things change. One of those things is they get to accomplish more and grow faster, assuming they have a scalable business. But they will also experience a change in accountability. No longer are they only accountable to the founding team and other team members; they suddenly have to answer to their new investors, who might have different interests, beliefs, and motivations than they do. The more investors they take on over time, the more varied those interests, beliefs, and motivations will be, and the more they’ll have to accommodate or negotiate with them.

Like many things in business, up-front time and effort spent on fundraising strategy can pay huge dividends later. It translates to increased odds of raising the right amount of money to reach the next significant milestone for making another want-versus-need decision and generally controlling their destiny. Surely, they know things won’t play out exactly as planned, but that doesn’t relieve them from the obligation to start with a strategy. After that, they can do what every great entrepreneur does—adjust and adapt as necessary.

Iterations to fundraising strategy may also happen as you test-drive ideas and assumptions with investors before actually launching the fundraising campaign. That takes place during the planning phase of fundraising—and is the topic of the article in the next issue of Texas CEO Magazine.