Mortgaging Your Monet

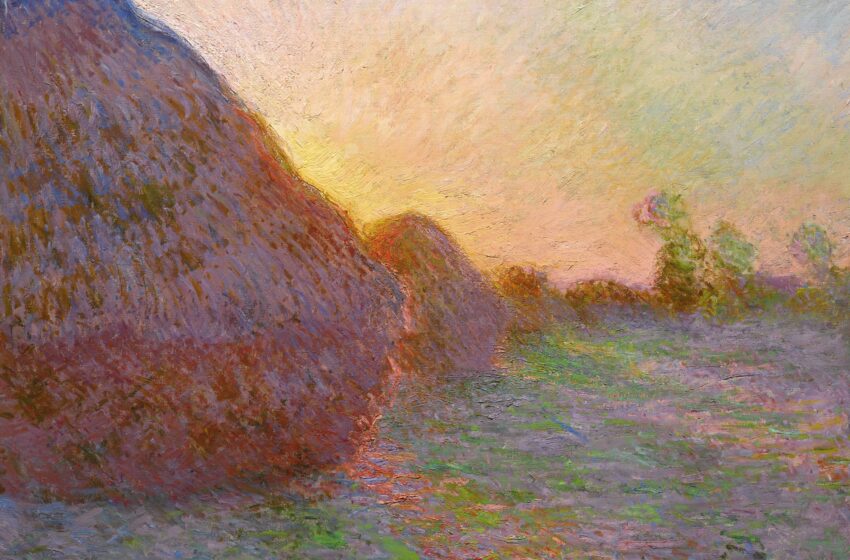

Claude Monet’s Meules (1890)

Bank of America’s Evan Beard on the Burgeoning World of Art Services

Where does the inherent value of art come from?

As managing director of Fine Art Services for Bank of America Private Bank, Evan Beard hasn’t quite solved this philosophical quandary. But that hasn’t stopped him from pioneering a group at Bank of America centered around art’s power to help his clients thrive, culturally and financially.

There’s no question that art ownership can pay off monetarily. When Claude Monet’s Meules—a seminal work of Impressionism—sold at Sotheby’s last year, it pulled an eye-popping $110.7 million. That’s more than 44 times what the painting last sold for in 1986, and quite a return for the seller. Any old layperson can be stunned by Monet’s brilliant daubs of color in Mueles, the sensuous sunlight peeking over the shoulder of squat purplish haystacks. But dealing with such artworks as an asset class is a trickier proposition. Even sophisticated art patrons and cultural institutions often need help maximizing the potential held in the paintings on their walls and the sculptures on their lawns. That’s precisely where Beard comes in.

Beard was working as a consultant to the private bank within Bank of America when, four years ago, the idea of an art division first hit. “My objective as a consultant was to figure out how to differentiate the bank as a brand,” says Beard, “and to figure out how to do that in a way that drove revenue growth.” One resulting concept was a unified business focused on the art market. Soon, Beard was hired on by Bank of America, tasked with pulling together the bank’s existing art offerings into one coordinated unit, styled as an investment banking group catering specifically to the art market.

Four years on, Bank of America Private Bank’s art division offers a full suite of services for assisting clients as they navigate the sometimes puzzling art world. As Beard discusses in the following interview, the strategies his group employs aren’t necessarily new (Rembrandt, for example, used his paintings as collateral). What is new is the evolving relationship between art and finance—felt not just in New York but in Texas too.

Texas CEO: Let’s start with what Bank of America Private Bank’s art division actually does. What do clients come to you for, typically?

Beard: Sure. The art services group at Bank of America Private Bank emphasizes four areas. The first is art lending. Led by our head of art lending, John Arena, we’ve helped collectors unlock billions from their art collections. By taking advantage of those credit structures, our clients can use their collections as collateral to unlock capital for a whole variety of uses, all while keeping the art on the wall.

We’ve done some really interesting things in art lending. For example, we took capital out of an art collection so the owner of a major league sports team could pay a signing bonus for a star athlete. In another case, we helped finance the expansion of a hip-hop artists’ enterprise using his art collection. Other times, people are looking to finance real estate projects or private equity funds. And in some cases they use the line to buy even more art.

One of the more interesting deals we did was enabling a collector to use his art line to back a third-party guarantee on a picture coming up at auction. The fierce bidding made it one of the most valuable ever sold, so our client didn’t walk away with the picture. But by guaranteeing the picture with his art line, he walked away with millions, pocketing a spread above his guarantee level and the hammer price.

The second area we work in is art planning, led by our head of art planning Ramsay Slugg. Ramsay sits in Fort Worth, where, as you know, there is a thriving art scene. Through that group, we work with collectors on the longer-term disposition of their art collection. We assist with everything from cross-border tax planning to philanthropic advice to entity structuring to estate planning. We can even advise on the process of building and structuring a private museum.

Our third area is consignment services. Led by our New York-based specialists Drew Watson and Dana Prussian, we oversee the negotiation and sales process for clients selling art and objects at auction. Through our official relationships with the auction houses, we negotiate guarantees and help clients save on consignment fees.

And finally we have an institution endowments group and manage about 100 museum endowments across the country. Our team of consultants, led by Dianne Bailey, advises institutions on everything from strategic planning to board best practices to de-accessioning advice.

Through those four areas, we’re trying to be relevant to the collector through the entire collecting journey—from the moment they start to collect to when their collection is sitting in a museum.

Texas CEO: For the typical collector, how new is the idea of using something like an art services group?

Beard: In a sense, art’s relationship with banking dates to the Renaissance when dynasties like the Medici would fund art projects to stay in the good graces of the church. Art-secured lending then appears in the Dutch Golden Age when artists like Rembrandt and Jan Lievens would use their art as collateral to merchants to fund their studios.

But only in this generation has the global art market ecosystem evolved to a degree that global financial institutions focus on the art market as an industry in its own right, rather than simply a lifestyle hobby of their clients. Collectors now have an array of options, both on the financing side and on the philanthropic and wealth-planning side. That’s fairly new to the art world. Some people cringe at this convergence of art and finance; others find it useful. Either way, it’s a reality.

Texas CEO: With this concept being somewhat new, how difficult is it to make people aware of what you do and what their options are?

Beard: Part of our focus these last few years has indeed been educating collectors on what options are out there. But collectors tend to be a school of fish, congregating at art fairs and auctions, so word travels fast. The word is out and we’ve seen a real shift on how collectors manage their collections. It’s still appreciated as art, but now managed more as a capital asset.

Texas CEO: New York is clearly the center of the US art world, but have you seen more activity happening in states like Texas?

Beard: Absolutely. I live in New York, but it’s been fun to watch Texas cultural scene grow by leaps and bounds lately. In the minds of many Americans, Texas is rooted in certain industries—oil, natural gas, farming. But Austin, Dallas, and Houston have become key drivers in the arts and culture space. Texas has some of the deepest and most well-endowed art institutions globally and a very sophisticated and adventurous collector base.

In the past generation or so, the Texas model of close collaboration between collector and institutional curator has actually changed how museum interact with their patrons. Take the Dallas Museum of Art for instance; the institution collects in concert with several of the local collectors who have made long-term bequests to the institution. They’ve created a model where collectors now curate their own collection to fill long-term gaps and enhance the collection of the local institution for the benefit of future generations. This model might have been criticized years ago, now it’s every museum’s great ambition, particularly in rapidly growing collector scenes like Miami and Los Angeles.

Texas CEO: How has COVID-19 and the current economic climate impacted the art market?

Beard: It’s had an effect, clearly, but it’s affected some segments of the art market more than others. In the 2009 crisis we saw the art market pull back by almost 50 percent on the supply side, but demand also sunk because there was a liquidity squeeze at the high end driving prices lower.

The current crisis has primarily hit Main Street. This time around prices at auction have been stable, partly due to a monetary response—the drop in interest rates, the expansion of the Fed’s balance sheet—that has stabilized capital markets and thus demand at the high end. So the masterpiece market is holding very firm, because there’s plenty of liquidity.

We brought a single-owner collection to auction during the depths of COVID and we questioned whether demand would materialize. Luckily Sotheby’s did a tremendous job pulling off a digital hybrid sale that drove robust bidding for several female artists including Louise Bourgeois, Joan Mitchell, Helen Frankenthaler, and Lee Krasner. It demonstrates that fresh-to-market works by great artists can pretty much survive a nuclear winter.

The sector of the art market that has been dramatically hurt by this crisis is the middle tier at auction and in the primary gallery segment. In the age of social distancing, art exhibitions and gallery showings have become logistically challenging and basically every art fair globally has been cancelled this year. Prices in the primary dealer market will adjust downward and take some time to come back. It’s a good time to support those gallerists and artists.

Texas CEO: What personally drew you to this work? Do you collect art yourself?

Beard: I’m drawn to the New York school. My very small collection is focused on art that evokes New York City in some way.

As for how I came to work in this field, it was in a roundabout way. I went to the US Naval Academy and became a naval intelligence officer, with most of my focus on the Middle East. But even then I was fascinated by the economic and social structure of certain markets. While working in naval intelligence, I would go to these cities, from Dubai to London, and I’d always pop into the local museum, art gallery or auction house. I never could quite rationalize what drove the value of the objects. For whatever reason, I felt led to explore whether the market was irrational, or whether there were rational economic laws in place? So I got out of the navy and went Oxford University where I focused a bit on behavioral economics, partly to explore the behavior behind luxury assets like art.

Today, the most interesting and fun part of the role is definitely the living-room discussions I get to have with collectors, surrounded by some of the great private art collections of our generation. It’s like being in the early 20th century and sitting among those great collections of the Morgans and the Fricks and the Huntingtons—now on display in the National Gallery, the Metropolitan, and their own respective museums.

I get to see these great collections, talk about them, and understand how they were put together. I get to understand the philosophy and the biography behind each collection. And now, in this financialized age, I also get to work with the collector to unlock capital from the collection so they can do big things on the business side.