Houston Deal Highlights: Q1 2022 Venture Report

Mason Rathe’s Texas Deal Highlights showcases the state’s vibrant tech and startup ecosystem, from fundraising, mergers and acquisitions, to other major company announcements and news. Here, Mason looks back at some of the biggest venture deals in Houston at the beginning of this year. For similar quarterly reports on Dallas and weekly updates on Austin, subscribe at texasdealhighlights.com

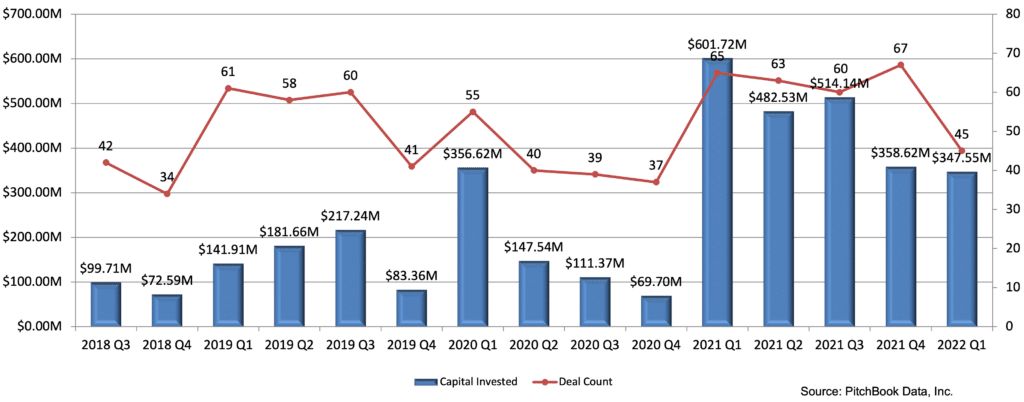

Five! Count ’em, five straight quarters with over $300 million in venture funding in Houston!

Six years ago, we were barely cracking that $300 million number for the year, and now it’s below the quarterly average. My deal updates are a lot easier to write when we have major activity, and bringing in $348 million certainly fits the bill.

I’ve said it before and I’ll say it again—these numbers are based on years of hard work from the organizations that have built the startup infrastructure in Houston. It’s amazing to see the company-building and value-creation that’s happening in that part of the state.

Houston Venture Activity

Here are your 10 biggest venture deals of the quarter:

- Encina, the Woodlands-based developer of technology designed to produce renewable products from waste plastic, raised $55M of venture funding from IMM Investment and SW Recycle Fund

- Avelo Airlines, a Houston-based airline, announced a $42M Series B round, led by Morgan Stanley Tactical Value. Avelo has now raised $167M since beginning service in April 2021.

- Ecommerce Brands, a Houston-based e-commerce aggregator platform, raised a $40M round, including $10M in equity, led by Bearing Ventures.

- MetOx, a manufacturer of high-temperature superconducting wire, raised $28M of Series A venture funding from Safar Partners and other undisclosed investors.

- Zeta Energy, a Houston-based battery manufacturer, announced a $23M Series A round, led by Moore Strategic Ventures. Zeta has raised $27.2M to date for their novel lithium sulfur battery technology.

- Stream Biomedical, developing neuroprotective and neuroreparative therapies for individuals suffering as a result of neurologic trauma and/or degeneration, raised $21.5M Series A from undisclosed investors

- Zinnov, the Woodlands-based global management and strategy consulting firm, raised a $20M Series A from HKW.

- Decisio, a clinical decision support platform designed to aggregate and prioritize real-time patient data, raised $18.5M Series B venture funding from Declatex, GE Healthcare, and UT Horizon Fund. The company has raised $31.5M to date.

- Vivante Health, a Houston-based chronic disease management platform, raised $16M Series A led by 7wireVentures. The financing round was joined by new investors Human Capital, Intermountain Ventures, SemperVirens, Elements Health Ventures, and Leaps by Bayer. Returning investors FCA Venture Partners, NFP Ventures, Lifeforce Capital, and Big Pi Ventures also participated in the round. The company has raised approx. $50M to date.

- SiteAware, a Houston-based construction AI platform, announced a $15M Series B round, led by Vertex Ventures Israel. SiteAware has raised $26.5M to date with other investors, including Axon Ventures and Robert Bosch Venture Capital.

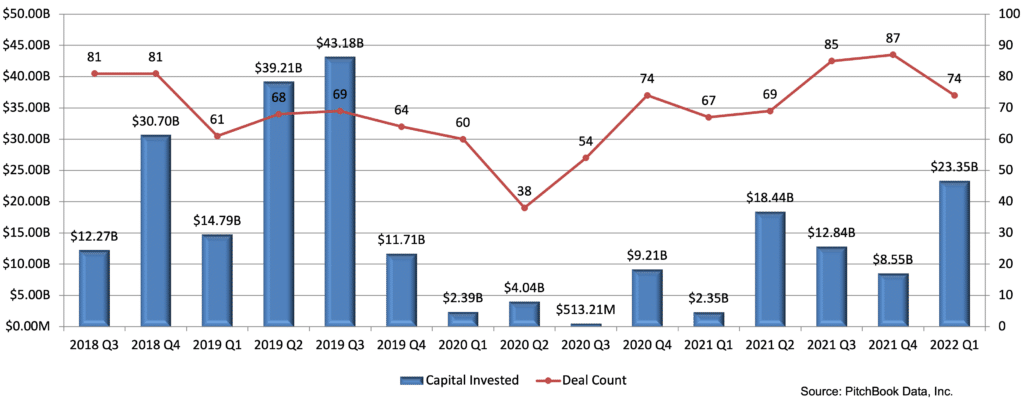

Houston M&A Activity

As you can see below, Houston M&A activity in Q1 was the highest it’s been since Q3 of 2019:

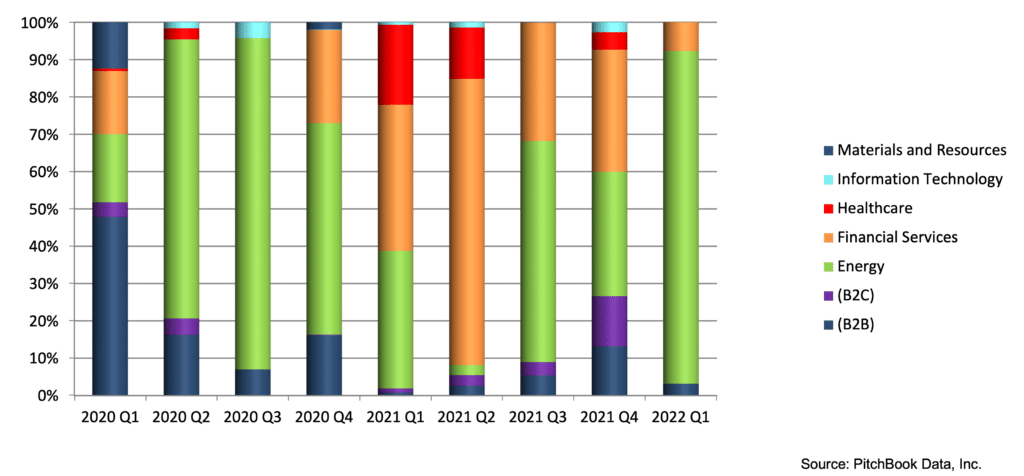

Usually, I break down the M&A activity strictly for software companies, but considering that there were 12 acquisitions in this sector and none of them decided to disclose the deal terms, that chart wouldn’t tell the right story. Houston is a huge economy, and as tech accelerates its momentum in the tech arena, there are other key industries that have made this the seventh-largest metro GDP in the country, at over $500B. Let’s take a look at the acquisitions that did occur in these other sectors.

As you can see, Q1 of 2022 was dominated by the energy industry, a common theme in Houston’s identity, which claims headquarters of major energy companies including Phillips 66, Baker Hughes, ConocoPhillips, and Halliburton. These companies also happen to be key customers for startups in the area. As venture-backed companies continue to build value in Houston, we will most certainly see more M&A activity and IPOs to follow.

Stay tuned!